For Borrowers

- Pros of P2P lending include a lower rate of interest involves, and also there is a fixed rate of interest, then customers are provided with the digital experience of facilitating the rapid flow of transaction and there are Lower fees involved.

- Cons of P2P includes as compared with banks, it involves less/low amount of loan, and there is less security involves, also sometimes it happens that the number of borrowers is more than the number of lenders.

For Lenders

- Pros of P2P lending include higher returns, it involves a wide variety of options available to put their capital into, and direct communication with buyers is involved.

- Cons of P2P includes returns in case of P2P is lower as compared to a publicly-traded index fund.

There are the scope of activities that are involved under P2P lending and they are as follows -

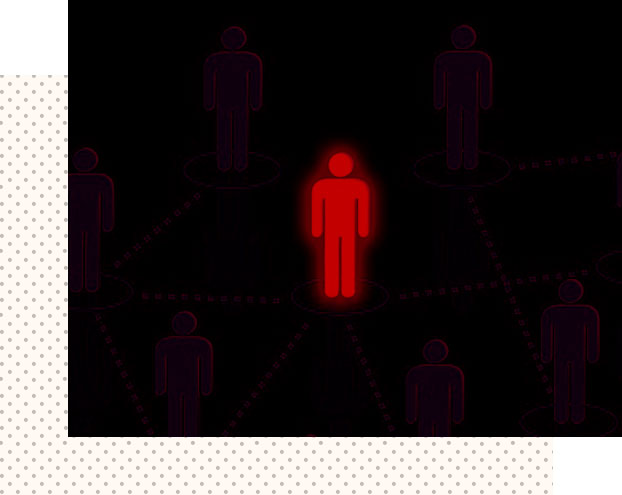

- Act as an intermediary

- P2P lending platform is not permitted to lend on its own

- Not permitted to arrange credit enhancement/ guarantee

- P2P lending platforms do not possess the power to permit any secured lending.

- Any other financial product cannot be sold.

- The international flow of funds cannot be permitted

- It is mandatory to adhere to all mandatory legal norms

- Consumer Lending This includes loans for cars, self wedding, holidays, home repairs, etc.

-

Small Business (SME) Lending

Small Businesses loans are given to small businesses for the following purposes

- Working Capita

-Business Expansion

-Asset Finance - Property Lending This is considered secured P2P lending. Generally, the loan is borrowed for [personal mortgages, Buy-To-Lets, Residential Refurbishment, and developing commercial loans

- The company should be registered in the country as a Private Company or Public Company with the principle objective of financing.

- Minimum net owned funds as described by the national bank.

- Website/Mobile app workflow

- The online application is available on the national bank website.

- Submission of a hard copy of the application along with attached documents shall be submitted.

- The License will be granted only after vigilant inspection of the application and documents attached with it.