- Home

- About us

-

Services

- Blockchain Crypto Legal Consulting

- Cryptocurrency License Consulting

- Crypto & Blockchain Lawyer

- Dubai Crypto License

- Stablecoin Legal Consultant

Blockchain And Crypto

Virtual Assets

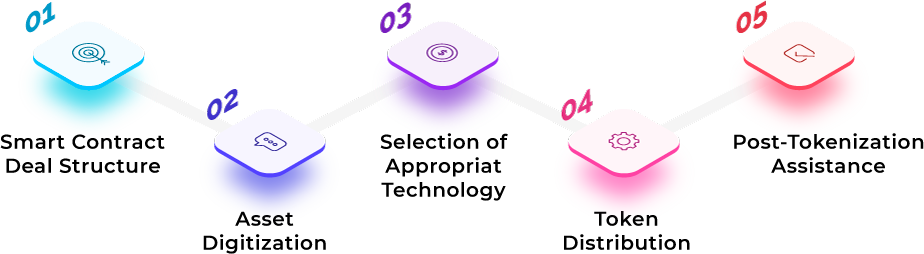

Tokenization

Financial Law

Misc.

- Blog

- Knowledge Base

- events

- Contact